This includes the potential loss of principal on your investment. The actual rate of return on investments can vary widely over time, especially for long-term investments. It is important to remember that these scenarios are hypothetical and that future rates of return can't be predicted with certainty and that investments that pay higher rates of return are generally subject to higher risk and volatility. Savings accounts at a financial institution may pay as little as 0.25% or less but carry significantly lower risk of loss of principal balances. The lowest 12-month return was -43% (March 2008 to March 2009). Thus if the final lease were to be classified as a finance lease simply because of its position in the chain, this would normally be unacceptable. From Januto December 31 st 2021, the average annual compounded rate of return for the S&P 500®, including reinvestment of dividends, was approximately 11.3% (source: Since 1970, the highest 12-month return was 61% (June 1982 through June 1983). The lessor is recovering the investment in the asset through a number of leases and the substance of each of those leases will normally be an operating lease. The Standard & Poor's 500® (S&P 500®) for the 10 years ending December 31 st 2021, had an annual compounded rate of return of 13.6%, including reinvestment of dividends. This lease versus buy car calculator will help you decide which option makes the most financial sense for you by comparing payments and the overall cost.

#Lease versus finance calculator plus

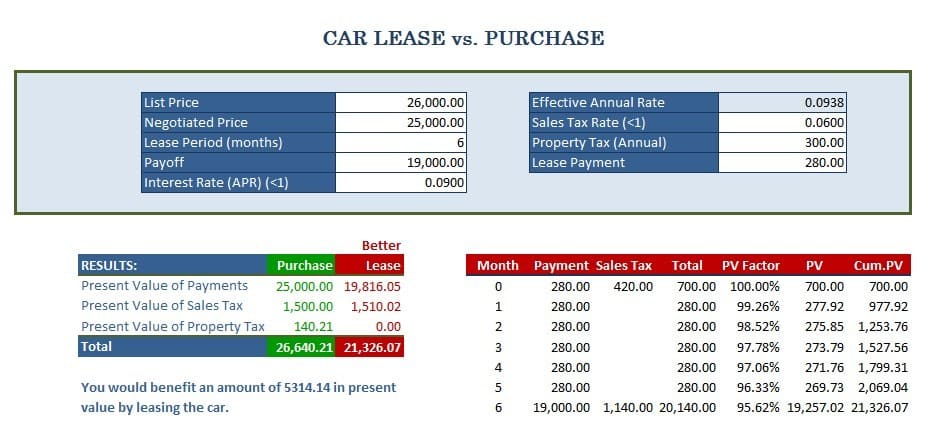

It is the product value plus total interest. Last but not least, you can also calculate the total cost to own a car after lease ends. So: 5,000 + 14,161.64 + 14,000 - 30,000 3161.74. Curious about your Porsche financing options Use our car payment calculator to estimate how much an auto loan will cost at our Burlington Porsche dealer. Learn more about leasing a car and getting a loan to help determine whats best. Leasing is the better option if you plan on using the vehicle for a few years, whether for business or personal purposes. The actual rate of return is largely dependent on the types of investments you select. To do so, you need to use the following formula: Downpayment + TotalPayments + ResidualValue - ProductValue Totalinterest. Finding the right vehicle financing option for your situation is essential. The main point of a car lease is to have a vehicle you can use without the commitment and responsibility of being a car owner. Simple input the correct values in the fields below and click on the 'Calculate. This is the return that you would make if you were to invest your down payment or security deposit instead of using it in your auto purchase or lease. The lease versus buy calculator is based on a range of the algorithms that are employed in the other calculators you will find on this site for example, the auto lease calculator, car loan calculator, and car depreciation calculator. Investment rate of return Rate of return on investments. Please note: The calculation assumes that you will achieve the average market value when you sell your car at the end of the lease term.

0 kommentar(er)

0 kommentar(er)